How Much Is It To Get

3. How much you'll get

Your Universal Credit is a single payment that is made up of different amounts depending on your circumstances.

The payment will take into account:

- your earnings if you are working

- your partner's earnings if they are working

- any other income that is coming into your household

To get an estimate of what you may be entitled to when you claim Universal Credit you can use a benefits calculator

The amount you get is worked out each month, so may be different from one month to the next if you earn a different amount, or if your circumstances change.

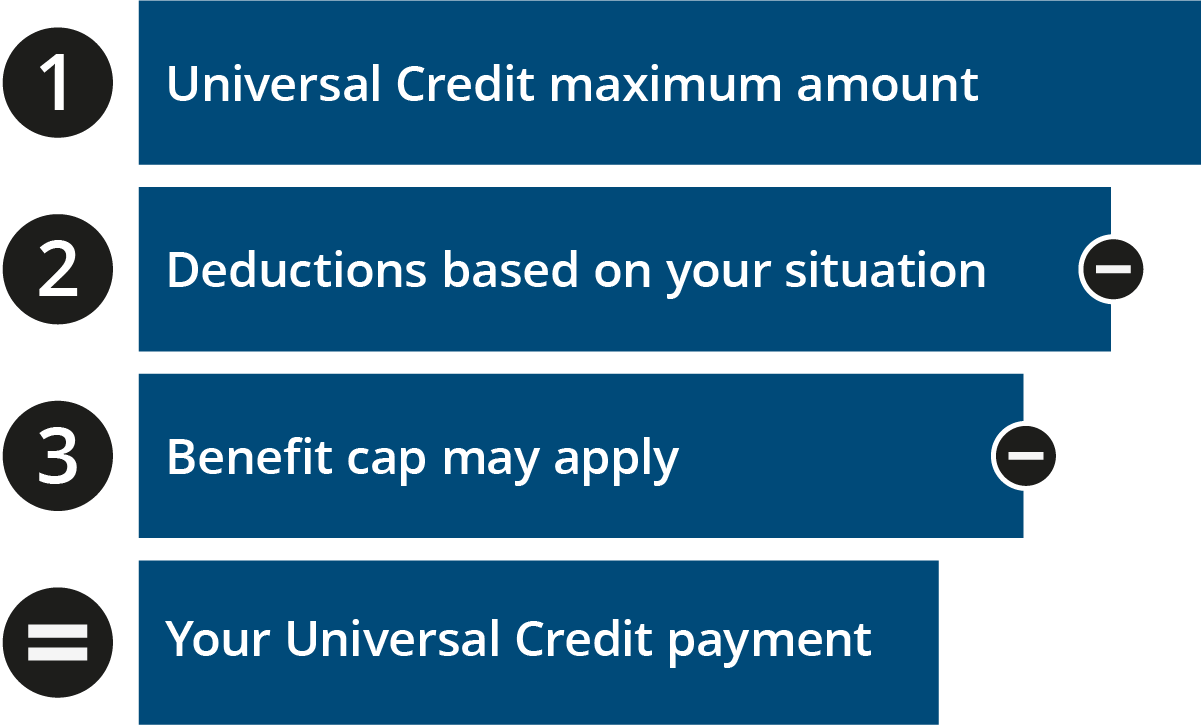

How your payment is calculated

There are 3 steps to work out your Universal Credit payment. More details about each stage are below.

- Your household's maximum Universal Credit amount is calculated. This will be made up of one standard amount and any additional amounts that apply to you and your household (for example, for housing costs or children).

- Money may then be taken off because of your earnings or other income (such as money from savings), to pay back any advances or loans you have taken out, or because arrangements have been made for money to go straight to your utility provider. If you have received a sanction, this will also reduce your Universal Credit payment.

- If it applies to you, the benefit cap may reduce how much you receive.

What makes up your payment

Standard allowance

Part of the Universal Credit payment is a standard amount for your household. This is known as your standard allowance. Your monthly amount will depend on whether you are single or in a couple, and your age.

Monthly standard allowances are decreasing from 6 October 2021, when the temporary increase for the coronavirus (COVID-19) pandemic ends.

| Your circumstances | Monthly standard allowance if your assessment period ends before 6 October 2021 | Monthly standard allowance if your assessment period ends on or after 6 October 2021 |

|---|---|---|

| Single and under 25 | £344.00 | £257.33 |

| Single and 25 or over | £411.51 | £324.84 |

| In a couple and you're both under 25 | £490.60 | £403.93 (for you both) |

| In a couple and either of you are 25 or over | £596.58 | £509.91 (for you both) |

Children and childcare

Universal Credit can provide support to help with the costs of bringing up children. The amount you may be able to get is shown here, and there's more detail in the section on children and childcare

Child amount

If you are responsible for a child (or children) who normally lives with you, you may qualify for the child amount.

| Number of children | Extra monthly amount |

|---|---|

| For your first child | £282.50 (born before 6 April 2017) £237.08 (born on or after 6 April 2017) |

| For your second child | £237.08 per child |

Disabled child amount

You may get extra money if your dependent child is disabled. This Disabled Child Addition is paid at either a higher rate or a lower rate.

To qualify for the lower rate your child must be entitled to:

- Disability Living Allowance, or

- Child Disability Payment in Scotland, or

- Personal Independence Payment (for a child over 16)

To qualify for the higher rate your child must be:

- entitled to Disability Living Allowance (higher rate care component), or

- entitled to Child Disability Payment in Scotland (higher rate care component), or

- entitled to Personal Independence Payment (enhanced rate), or

- be certified blind

You can still receive a disabled child addition for a third or subsequent child, even if you do not get the basic child amount.

| Rate | Extra monthly amount |

|---|---|

| Lower rate | £128.89 per child |

| Higher rate | £402.41 per child |

Childcare costs

If you are a working parent, Universal Credit can help you with the costs of childcare no matter how many hours you work.

| Number of children | Maximum monthly amount |

|---|---|

| For one child | £646.35 |

| For 2 or more children | £1108.04 |

Carer's addition

You can get an additional amount of benefit if you are caring for a severely disabled person for at least 35 hours a week.

A severely disabled person is defined for these purposes as being in receipt of one of the following benefits:

- Disability Living Allowance (DLA) – middle- or highest-rate care;

- Constant Attendance Allowance (CAA) – at or above the normal maximum rate with an Industrial Injuries Disablement

- Benefit or basic (full day rate with War Disablement Pension);

- Attendance Allowance (AA);

- Personal Independence Payment (PIP) – either rate of the daily living component; or

- Armed Forces Independence Payment (AFIP).

Carer's Allowance

The other carer related benefit available, Carer's Allowance [link], is a separate benefit outside of Universal Credit. Eligibility for the carer addition in Universal Credit does not depend on your also claiming Carer's Allowance. Where it is claimed, it is deducted in full from your Universal Credit entitlement. However, there are other benefits to be gained by claiming Carer's Allowance.

Multiple carers

Only one person can receive a carer-related benefit (the Universal Credit carer addition and Carer's Allowance) for caring for a severely disabled person. Where a disabled person has two or more carers, each providing care for at least 35 hours per week, and each claiming one or both of the carer-related benefits, those carers will have to agree between them who will receive the carer-related benefits. If they are unable to decide, a DWP Decision Maker will decide for them.

Severe Disability

The severely disabled person's Severe Disability Premium (SDP) or Extra Amount for Severe Disability (EASD) spell out entitlement is terminated where a carer-related benefit is paid for caring for a severely disabled person who is entitled to:

- Severe Disability Premium (SDP), or

- Extra Amount for Severe Disability (EASD) in Pension Credit

If you are entitled to both the carer's amount and either the 'limited capability for work addition' or 'limited capability for work and work-related activity' addition (see below for more information), you won't receive both amounts. Instead you will receive the larger of those two amounts.

| Your circumstances | Extra monthly amount |

|---|---|

| If you care for a disabled person | £163.73 |

Limited capability for work additional amount

If you have a condition that means you aren't able to look for work now but can prepare for work with the aim of working at some time in the future, you are entitled to a work allowance and, in couple claims, additional help with childcare costs.

The additional amount of benefit awarded for having limited capability for work does not apply to health-related claims for Universal Credit, or Employment and Support Allowance (ESA), made on or after 3 April 2017.

However, if you made your health related claim to Universal Credit before that date and:

- it was decided you have limited capability for work, and

- you were awarded the limited capability for work additional amount, and

- you remain in receipt of that additional amount

| Your circumstances | Extra monthly amount |

|---|---|

| If you were assessed as having limited capability for work, made your health related claim before 3 April 2017, and since then you continue to have limited capability for work. | £128.89 |

Limited capability for work and work-related activity additional amount

You can get an additional amount if you have a health condition or disability that affects your ability to carry out work-related activity. This is assessed through a Work Capability Assessment

If you are making a joint claim and you both are entitled to this addition, your payment will only include one amount.

You may have to wait 3 months for your limited capability for work and work-related activity amount to be added to your Universal Credit payment. There are instances where it can be added on straight away, such as if you were entitled to Employment and Support Allowance immediately prior to your Universal Credit claim.

Carer amount and the limited capability for work additional amounts

If you are entitled to either the limited capability for work addition or the limited capability for work and work-related activity addition, and the carer's amount and (see above for more information) you won't receive both amounts. Instead you will receive the larger of those two amounts.

| Your circumstances | Extra monthly amount |

|---|---|

| If you have been assessed as having limited capability for work and work-related activity | £343.63 |

If you're terminally ill you may get extra money from Universal Credit.

Find out more about how Universal Credit can help people with health conditions or disabilities

Housing costs

If you and/or your partner are responsible for paying rent (including some service charges) for the home you live in, or if you have a mortgage, Universal Credit may provide help towards the cost.

If you receive help towards housing costs it will be paid as part of your Universal Credit payment. It is your responsibility to make sure you pay your rent and other housing costs to your landlord in full.

If you are having trouble managing your money, or if you live in Scotland, you can ask to have your housing costs paid straight to your landlord. Talk to your work coach, use your journal or call the helpline for more information.

Find out more about how Universal Credit can help with the costs of housing

Earnings and other income

Other money coming into your household will be taken into account when working out your Universal Credit payment. This includes your earnings, any capital you have and any other sources of income (such as from a retirement pension).

Earnings

You may still be able to receive Universal Credit payments when you start work or increase your earnings. Your Universal Credit payments will adjust automatically if your earnings change, meaning you have the flexibility to take on part-time or short-term work.

As your earnings increase, your Universal Credit amount will go down, depending on your circumstances. For more information see Universal Credit and work

If you are part of a couple and have a joint award, then both your earnings will be used to calculate your Universal Credit payment.

Capital

Capital includes:

- savings, such as those in a bank or building society

- investments such as Bonds or ISAs

- property that you may own or part own (other than the house you live in)

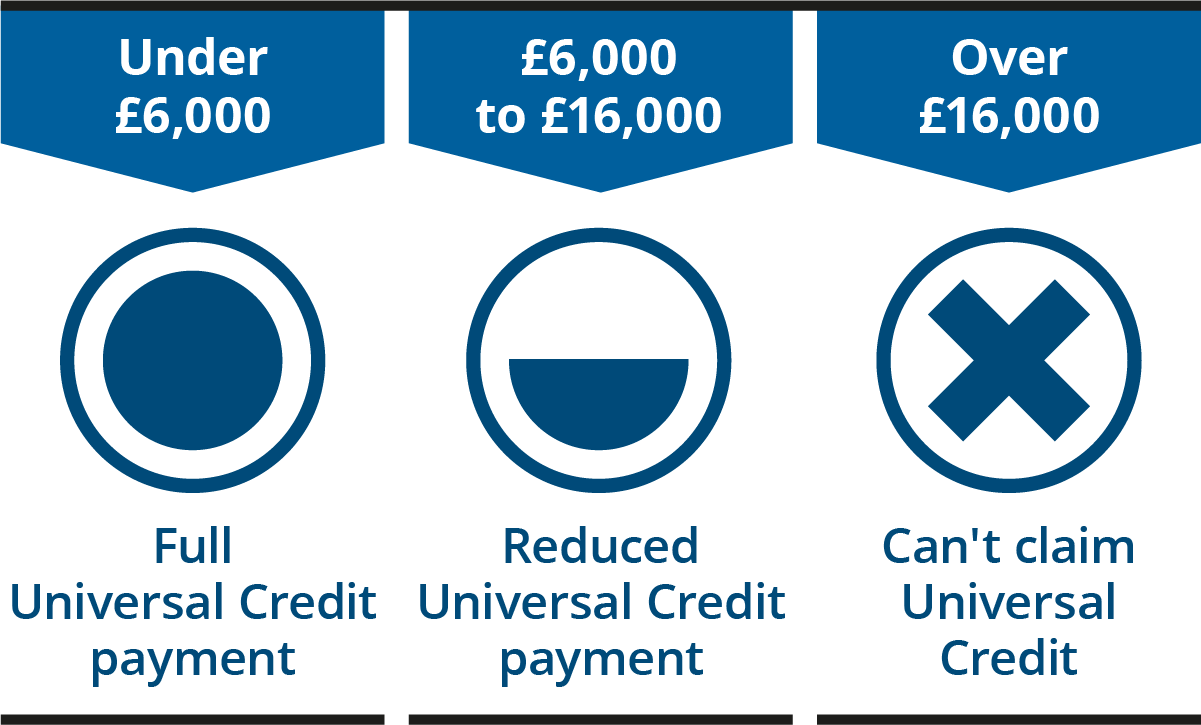

When you claim Universal Credit you will need to declare all of your capital. If your capital is worth more than £16,000 you will not be entitled to claim Universal Credit. If you are in a couple but have to make a claim as a single person, your partner's capital/savings will still be taken into account.

Here's how the amount of capital you have will affect your Universal Credit claim:

- Any capital/savings you have under £6,000 is ignored.

- Any capital/savings you have worth between £6,000 and £16,000 is treated as if it gives you a monthly income of £4.35 for each £250, or part of £250, regardless of whether it does or not. So if you have £6,300 in a savings account, £6,000 of it will be ignored and the other £300 will be treated as giving you a monthly income of £8.70.

- If you have capital/savings worth more than £16,000 you will not be entitled to Universal Credit. This is the same if you are a single claimant or are making a claim as a couple.

Other money coming into your household

This means any other money that you may receive, for example, from a pension or other benefits.

When you claim Universal Credit, you need to tell us about your income from other sources as this could affect the amount of Universal Credit you receive. These include:

- Retirement pension income

- Maintenance payments

- Student income

- Any other income which is taxable

You can be getting other benefits and also receive Universal Credit at the same time. For every £1 you receive from them, your Universal Credit payment will be reduced by £1. These include:

- Carer's Allowance

- Incapacity Benefit

- Maternity Allowance

- New style Employment and Support Allowance

- New style Jobseeker's Allowance

When working out your Universal Credit, there are some other benefits that aren't taken into account. These include:

- Child Benefit

- Disability Living Allowance

- Personal Independence Payment

- war pensions

More information is available at Universal Credit: What you'll get

Benefit cap

There is a limit on the total amount of benefit that most Universal Credit claimants can get. This is called the benefit cap, and how much it is depends on your circumstances.

If you live outside Greater London:

| Your circumstances | Benefit cap |

|---|---|

| Single and you don't have children, or your children don't live with you | £1,116.67 per month (£13,400 a year) |

| Single and your children live with you | £1,666.67 per month (£20,000 a year) |

| In a couple, whether your children live with you or not | £1,666.67 per month (£20,000 a year) |

If you live in Greater London:

| Your circumstances | Benefit cap |

|---|---|

| Single and you don't have children, or your children don't live with you | £1,284.17 per month (£15,410 a year) |

| Single and your children live with you | £1,916.67 per month (£23,000 a year) |

| In a couple, whether your children live with you or not | £1,916.67 per month (£23,000 a year) |

Help towards the cost of supported or sheltered accommodation isn't counted when working out the total amount of benefit you receive.

If you are already claiming benefits and are likely to be affected by the benefit cap rules, you will see this on your monthly statement. If you need additional help to meet rented housing costs you should contact your local authority to apply for a Discretionary Housing Payment

The benefit cap will not apply to some people. For example, it will not apply for 9 months where households received earnings of at least £569 per month in each of the previous 12 months (£604 for any month after March 2020). It's therefore important that you fill in your past earnings during your Universal Credit application, so that the Department for Work and Pensions can tell whether this rule applies to you.

Find out more about the benefit cap

Deductions

Money may be taken out of your Universal Credit payment:

- to pay back any advances or loans you have taken out

- to pay back any debt or overpayment on other benefits

- to pay your utility bills direct to the provider

- for child maintenance payments

The maximum amount of money that can normally be taken out of your payment for these reasons is 25% of your standard allowance.

Your payment may also be reduced if you have received a sanction. This can be up to 100% of your standard allowance if you are claiming on your own, or up to 50% of the standard allowance for each member of a couple.

If you used to claim tax credits and you received an overpayment, this debt will be carried over to Universal Credit. Your Universal Credit payments will be reduced until the overpayment has been paid back.

Read more about debts and deductions that can be taken from Universal Credit payments.

How Much Is It To Get

Source: https://www.understandinguniversalcredit.gov.uk/new-to-universal-credit/how-much-youll-get/

Posted by: brogdonbobed1996.blogspot.com

0 Response to "How Much Is It To Get"

Post a Comment